Currency Trading Basics : Understanding the Exposure Implications related to Exchange-Rate Fluctuations

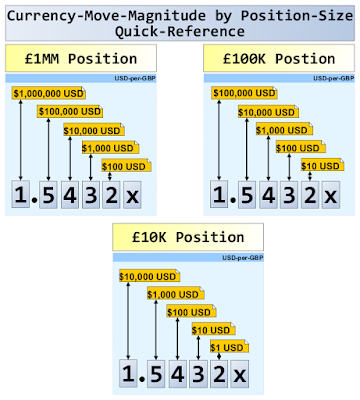

NOTE: see below for my handy Visual Aid, the Quick-Reference Diagram: Currency-Move (Exchange-Rate Fluctuations) and the Implied Magnitude of potential Gain / Loss (impact on your portfolio) depending on Exchange-Rate Changes and your current Position Size. Also, if using Currency-Trading for Hedging foreign-stocks, read my blog about Investing in ADR (American Depository Receipt) Stocks as a potential alternative approach.Just type the word "Forex" into Google Search and see what comes back. You will see countless ads for Online Forex Trading platforms, many of them advertising relatively very low initial account-opening deposit requirements (perhaps a few thousand dollars) and promising the opportunity to make huge gains and to allow you to leverage positions by a factor of up to 100:1, with relatively low "spreads" (the market difference between buy/sell prices of the currency pairs).

That all sounds wonderful! Or does it. Let's look into this foreign exchange market, or currency market, and any thoughts of using swings in exchange-rates to make money, a bit further first.

Potential for Very Rapid and Large Gains OR Losses

You had better first understand the implications of this foreign currency exchange or Forex "trading" — I place the word trading in quotes, because, especially when you are trading leveraged positions, it is really nothing beyond betting, and betting using money you personally do not have (hence why it is called leverage).Physical Positions (non-leveraged) in a Foreign Currency

If your particular broker / Forex-trading-platform allows, you can trade physical positions in foreign currencies (i.e., buy or sell one currency in exchange for direct holdings in another, and hold those balances in your account), but that is really what I would call "currency conversion" vs. currency trading, with the difference being that when you are holding a physical position in one or more currencies, it really isn't too much different than holding your US Dollars (USD) at a bank, more or less, because, if you wanted to transfer those physical holdings to a bank in a country that supported holding balances in that particular currency, you could do so, and you could (perhaps during a planned trip to a foreign country, or to a country where you own a vacation home, etc) withdrawal funds as you need in order to pay your expenses in the local currency. An example might involve you maintaining an account at Deutsche Bank in the EU, in Euros, where you could transfer some EUR holdings to if you needed money (in Euros) to pay for your summer vacation home or whatever.Your exposure to gains and losses is simply limited to the amount of each currency you hold physically (worst case), in the event you decide you need to convert any remaining physical positions back into USD or whatever. There is no leverage, thus there is no drastic multiplier of currency-swing effects. And, presumably, you wouldn't be holding substantial positions in one or more foreign currency unless you expected to potentially need it for things like travel, real-estate, or even perhaps purchasing a business or other investment in a foreign country.

This is quite different from...

Leveraged Positions in a Foreign Currency : True Forex Trading

When you are simply looking at currency-market volatility as a vehicle for potentially producing income, the game changes considerably. I am not going to get into all the exotic trading possibilities of things like various CFD instruments (Contract for Difference) and other derivatives, but rather just focus on trading the change in relative price strengths between simple currency-pairs. And, if you are venturing into these waters, you are most certainly doing so utilizing leveraged-positions.When I say "currency pairs", I am referring to the quotation and pricing structure of the currencies traded on the forex market. The value of a currency is a market rate determined by its comparison to another currency. The first listed currency within a currency pair is called the base currency, and the second currency is referred to as the quote currency.

Some common currency-pairs, which you can see on sites including Google Finance, include:

- EUR/USD (or EUR:USD if you prefer colon form) — where 1 unit in the base currency (in this case the Euro) is worth a certain number of the quote-currency (US Dollars here); a typical value for this in early 2017 would be perhaps around the 1.05 to 1.07 range, meaning that one Euro is worth (or buys you) between 1.05 and 1.07 Dollars.

- USD/JPY — the US Dollar / Japonese Yen

- GBP/USD — the British Pound Sterling (or Cable, or Pound) / US Dollar

- USD/CAD — the US Dollar / Canadian Dollar

- AUD/USD — the Australian Dollar vs US Dollar

Pick whichever suits your interests and where you expect you can earn money off fluctuations between the components of the pair.

So, you are ready to trade a currency-pair...

OK, time for some mathematics! You need to understand your exposure to market fluctuations in the currency-pair quotes, because markets can move fast, and when you are leveraged, the multipliers can become enormous.I created this graphic / diagram / chart / visual-helper (below) to try to demonstrate how much a seemingly small move in an exchange-rate can impact you, in either a good way (profit) or a bad way (loss).

I chose position-sizes that may sound large, but, considering that some Forex trading platforms allow you to leverage positions in currency-pairs up to a factor of 100:1, just think about that... with USD $10,000, at 100-to-1 leverage, that multiplier factor means that you are betting on a position of USD $1 million!

Now, I decided to use a GBP:USD currency-pair example in my above chart. Let's assume that at the point in time when I take a position in that pair, each British Pound cost $1.5432x (where "x" is some further decimal value if your trading platform goes down to that level of detail, which would be a fraction of a PIP). Oh, and a PIP = "price interest point", which measures change in the exchange rate for a currency pair, which when displayed to four decimal places, one pip is equal to 0.0001, or in my GBP:USD price chart example above, the column with the value "2" in it, four positions to the right of the decimal point.

Exchange-Rate Changes and Implied Profit or Loss

Referring to my picture (diagram / visual aid) above, let's consider how changes in the currently-quoted exchange rate will affect our paper gain/loss, based on different position sizes (and, keep in mind, I am considering the value of the leveraged position, not the amount you risked in order to leverage that amount; I will use a 100:1 leverage here too, each starting at the purchase-price of the $1.5432 per GBP):

- Scenario #1: (upper-right table in my graphic will be helpful) you buy a £100,000 position in GBP:USD, which would have cost $154,320 (plus any transaction fees), but at 100:1 leverage, the "cost" (amount put up for this bet / trade) is really just $1,543 (plus fees / commissions).

Now, the market value of the Pound increases by 20 PIPs, to $1.5452/GBP: your leveraged position is worth $154,520, thus, you have made $200 (less fees) if you sold at this point. Notice how my visual cheat-sheet makes this easy to quickly see and compute by looking at the column with the "3" in it (which has changed to a "5" now), you can see that each digit-change in that column implies an overall position-value change of $100. Your gain, in percentage-terms, could be very substantial: $200(less-fees)/1543 => ~13% (not counting fees). BUT, keep in mind, you could have just LOST that amount too! - Scenario #2: (upper-right table in my graphic will be helpful) you buy a £1,000,000 position in GBP:USD, which would have cost $1,543,200 (plus any transaction fees), but at 100:1 leverage, the "cost" (amount put up for this bet / trade) is really "just" $15,430 (plus fees / commissions) — you now have the price of a low-end new car on the line for this substantial bet / trade position! "

Now, some reasonable volatility hits the market following Mark Carney opening his mouth about something regarding British interest rates or the post-Brexit economy, and the next thing you know, the market value of the Pound moves lower by a full 100 PIPs (one cent), to $1.5332/GBP: your leveraged position is now worth $1,533,200, thus, you have lost a rather whopping $10,000 (plus fees) if you sold at this point.

Again, my visual cheat-sheet makes this easy to quickly see and compute by looking at the column with the "4" in it (which has changed to a "3" now), you can see that each digit-change in that column, at a £1,000,000 position-size implies an overall position-value change of $10,000. Your loss, in percentage-terms, is simply huge! $10,000(plus-fees)/15430 => ~65% loss (plus fees). Sure, you could have just gained that amount too if the rate change had gone in your favor!

But wait, there's more!

Don't overlook the overnight-interest-charges you will be hit with on your leveraged positions! Did you think you were going to get the implied-funds for 99% of your position for free? Think again! These can add up. And, especially keep in mind the cost of carrying these positions over weekends / holidays when markets will be closed! I am not going to get into the details of all that here, but perhaps I will later. My goal is to demonstrate the sheer magnitudes of potential movements in the value of your trading positions in relation to very small changes in the underlying exchange-rates.Potential BUST!

Next, consider that, although you can open a Forex trading account with rather low amounts, notice how, if you had opened an account with what may have seemed like a "reasonable" amount of money to you, that sudden changes and large swings in currency exchange rates (i.e., large volatility) can wipe you out in no time when the broker / trading-platform operator liquidates your account when your physical currency holdings cannot cover the current implied market-price move (i.e., implied loss on your holdings), if even for a minute,... goodbye everything.

This is all the more reason you really need to understand the implied possible changes to your position when the market swings. Think carefully about this. Don't take on positions where unexpected market events (e.g., an unexpected rate-rise or cut by a central bank) could move rates 2%, and thus wipe you out if you are on the wrong side of things.

Continue to read this Software Development and Technology Blog for computer programming articles (including useful free / OSS source-code and algorithms), software development insights, and technology Techniques, How-To's, Fixes, Reviews, and News — focused on Dart Language, SQL Server, Delphi, Nvidia CUDA, VMware, TypeScript, SVG, other technology tips and how-to's, plus my varied political and economic opinions.

Continue to read this Software Development and Technology Blog for computer programming articles (including useful free / OSS source-code and algorithms), software development insights, and technology Techniques, How-To's, Fixes, Reviews, and News — focused on Dart Language, SQL Server, Delphi, Nvidia CUDA, VMware, TypeScript, SVG, other technology tips and how-to's, plus my varied political and economic opinions.